Dealing with unexpected medical bills after an injury is often worse than the injury itself. The system isn’t built to make life easier – it’s a maze of codes, charges, and policies designed to confuse you into paying more than you owe. If that’s where you find yourself, you’re not alone.

You deserve clarity, actionable solutions, and peace of mind. So join us as we take a look at how to take control of the chaos.

Step One: Scrutinize Every Bill

Medical billing is riddled with errors. Overcharges, duplicate fees, and billing codes for procedures you didn’t even receive? They’re practically standard. Every bill demands close attention. Comb through every line item. Question everything.

If something doesn’t add up, call the billing department and demand answers. Yes, demand. This is your money, not a suggestion box for their accounting errors. Don’t hesitate to ask for itemized receipts or detailed explanations for any charges that look suspicious.

They might try to rush you off the phone. Don’t let them.

Step Two: Know Your Coverage

Your insurance company is not your friend. Their goal is to pay out as little as possible. But knowing your coverage inside and out puts you in the driver’s seat. Review your policy for what’s covered, what’s not, and how much you’re expected to pay out-of-pocket.

If they deny a claim, appeal it. Don’t let a “no” from them be the final word. Insurers count on people giving up. Show them you won’t.

Also, don’t forget about the No Surprises Act. It protects you from surprise bills in certain situations, especially emergency care. If your provider isn’t playing fair, this act can help you push back.

Step Three: Understand Financial Resources

Medical bills aren’t a life sentence. Resources exist to help you get through the worst of it. For example, consider how medical liens work. A medical lien allows your healthcare provider to delay payment until your personal injury settlement comes through. It’s not charity, but it can buy you time and prevent immediate financial ruin.

Want to know more? Here’s what you need to understand about medical liens.

Additionally, many hospitals have financial assistance programs, although they rarely advertise them. These programs could reduce your bill significantly, sometimes even wiping it out entirely. You’ll need to apply, often with proof of income, so don’t procrastinate.

Step Four: Negotiate Like It’s a Business Deal

Because it is. Medical providers aren’t non-profits. They want to get paid, and they’ll negotiate if it means avoiding unpaid bills. Reach out to the billing department and ask for a discount or a payment plan. Be upfront about your financial situation.

If you have cash on hand, offer to pay a lump sum at a reduced rate. It’s surprising how many providers will take 50% (or less) just to close the file. Doing so can go a long way in reducing financial stress over the long haul.

Step Five: Bring in a Specialist

If all of this feels overwhelming, you’re not imagining things. The system is complex by design. That’s where professionals like medical bill advocates come in. They specialize in deciphering cryptic bills, identifying errors, and negotiating on your behalf.

Yes, they charge for their services, but often the savings they secure more than cover their fees.

Step Six: Consider Legal Action

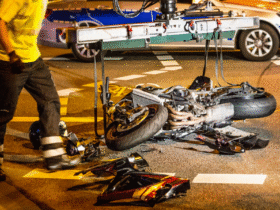

If your injury was caused by someone else’s negligence, a personal injury attorney can be a game-changer. They’ll help you pursue compensation to cover your medical bills, lost wages, and more.

This is where medical liens and Letters of Protection come into play. These tools allow you to receive necessary care without immediate payment, using your future settlement to cover the costs.

Step Seven: Don’t Let Bills Linger

Unpaid medical bills won’t vanish on their own. If ignored, they can go to collections, wreck your credit score, and create even more problems.

If paying in full isn’t an option, stick to your negotiated payment plan. Keep in contact with your provider to prevent misunderstandings. And if you run into issues, address them immediately.

It’s tempting to shove these bills to the back of the pile, but doing so only gives the system more leverage over you.

Step Eight: Rethink Your Budget

When all else fails, it’s time to tighten the belt. Look for areas in your budget where you can cut back temporarily. Channel those savings toward medical bills until you’re out of the red.

This might mean postponing nonessential expenses or redirecting funds from savings. It’s not ideal, but it’s better than letting unpaid bills dictate your financial future.

Take Action Now

The medical billing system is a beast, but it’s one you can tame with persistence and strategy. Stay vigilant. Stay informed. And most importantly, don’t let the system bully you into silence. Every action you take now brings you closer to financial freedom and peace of mind.

Leave a Reply